What is Series A Funding?

Series A funding is a crucial stage in the financing process of a startup, where a company raises capital in exchange for equity. It typically occurs after a startup has validated its product or service through seed funding and has demonstrated initial traction. The funds raised in a Series A round are used to scale the company, expand the team, and increase marketing efforts. The typical investment amounts in a Series A funding round can range from $2 million to $15 million, depending on the size and growth potential of the company.

How do you prepare for a valuation discussion with potential investors?

To prepare for a valuation discussion with potential investors, it’s crucial to understand your company’s financial position and market potential. Here are some steps you can follow:

- Know your financials: Review your company’s financial statements, including balance sheets, income statements, and cash flow statements. Ensure that your financials accurately reflect the current state of your business and project realistic future growth.

- Know your market: Research your industry, competitors, and target market. Understand the current market conditions, industry trends, and the potential for growth in your market.

- Determine your value proposition: Clearly articulate the value that your company provides to customers, how you differentiate from competitors, and what makes your business unique.

- Prepare your pitch: Practice your pitch to investors, including the key elements of your value proposition, financial projections, and what you plan to do with the funds you raise.

What are some key things to remember when pitching your company to investors?

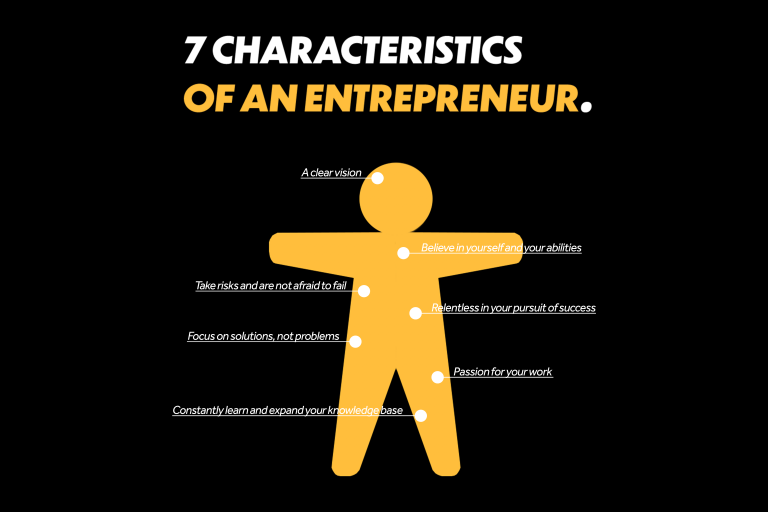

When pitching your company to potential investors, it’s important to keep in mind the following key things:

- Be confident and passionate: Investors want to see that you believe in your product and that you are passionate about your company.

- Articulate your vision: Clearly articulate your company’s mission and the problem you are solving.

- Show traction: Demonstrate that you have already made progress towards your goals, including metrics such as revenue, user growth, and market penetration.

- Be transparent: Be honest and transparent about the challenges your company faces and the risks involved in investing.

- Show a clear plan for growth: Demonstrate that you have a clear plan for how you will use the investment to scale your company and drive growth.

How do you negotiate terms with potential investors?

Negotiating terms with potential investors can be a complex process, but by being prepared and understanding your company’s strengths and weaknesses, you can increase your chances of securing the best terms for your business. Here are some tips for negotiating terms with investors:

- Be flexible: Be open to feedback and be prepared to negotiate the terms of the investment, including the valuation and the equity stake you are offering.

- Know your bottom line: Determine what terms are non-negotiable and what compromises you are willing to make.

- Be transparent: Be honest with investors about the company’s strengths and weaknesses and be transparent about the terms you are proposing.

- Seek advice: Consider seeking advice from a trusted advisor or mentor who has experience in negotiations.

What are the benefits of taking on Series A funding?

Finally, the benefits of taking on Series A funding include the ability to scale the business, increase marketing efforts, and hire a larger team. Additionally, taking on investment can help validate the business and increase the chances of securing additional investment in the future. By successfully securing Series A funding, startups can take their business to the next level and drive growth towards achieving their goals.

In conclusion, securing Series A funding is a critical step in the growth of a startup, and it requires careful preparation, including a deep understanding of the company’s financials and market potential, and a well-prepared pitch to investors. By being transparent, realistic, and well-prepared, startups can increase their chances of securing the investment they need.

How do we teach you this at Unknown University of Applied Sciences?

At Unknown University of Applied Sciences, we make it our mission to make the starting and growing of your business the best experience possible. On top of providing a highly specialized bachelor’s and master’s programs connection to our Learning Facilitators and Business Coaches, and access to our incubator-like workspace, you will receive access to our ever-growing network of experts and entrepreneurs, as well as connection to our venture capital funder: Unknown Group. Through these opportunities, discover the best way to find solid ways to grow capital.