When embarking on the journey of seeking investors for your business, it’s important to carefully consider key factors that can significantly impact your success. Finding the right investors who align with your vision, goals, and values is crucial for long-term growth and sustainability; and getting an investor on board is like getting married, or even more intense, legally speaking. In this article, we hear from Nira de Waele, Business Coach and Field Expert at Global School for Entrepreneurship, as she shares 7 helpful tips to consider before looking for investors. By understanding these factors and making informed decisions, you can maximize your chances of securing the right investment partners who can fuel the growth of your business and help you achieve your goals.

1. Research Who You’re Pitching To

It’s important to understand exactly who you are pitching to. What do they care about? What do they invest in? What’s their ticket size? Really understand what their profile is, and see if you fit their criteria, or adjust your pitch accordingly.

2. Find the Right Match

There needs to be a match between you as a founder and the investor because they handle a lot of power. It’s very expensive to get rid of shareholders, sometimes it’s messier than a divorce. When you choose an investor, you need to make sure that you are on the same page. If you don’t speak the same language, if you don’t have the same vision, you shouldn’t feel motivated to involve yourself with them. You shouldn’t go “Oh my god, money!” You have to ask yourself: Does it fit? Does it make sense? Will you get along?

3. Raise Money Before You Need Money

The investment process typically takes 6 to 9 months from meeting until there’s money in the bank. Investors can smell you running out of money, which puts you in a weaker position for negotiation. By seeking investments while already having some sort of cash flow, you can make less desperate decisions when securing partnerships.

4. Investors Are Looking To Decrease Their Risk

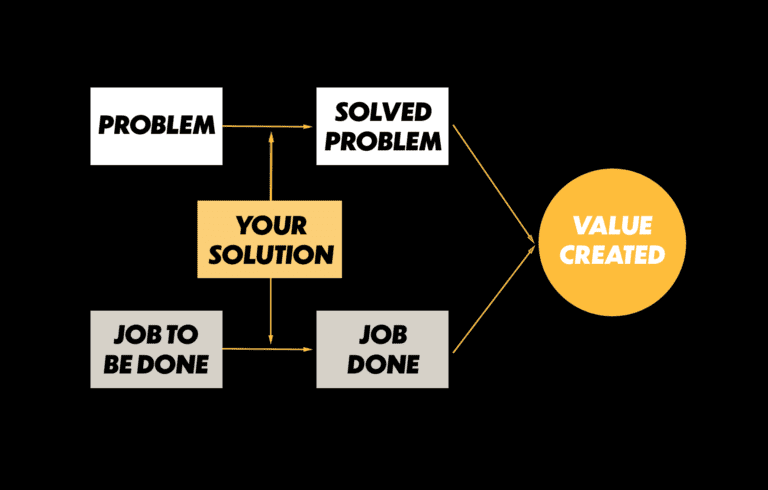

Be realistic, show proof from the real world. You have to convince investors that it’s not just an idea, but that it’s also grounded in reality. Whatever connection, letter of intent, tangible traction, or proof of desirability you can show them will increase your chances to secure an investment.

5. Investors Don’t Have The Same Interests As You

They’re looking for a return on investment. They are not particularly concerned with the health of the founder or the business. Investors are not necessarily builders, they want to make money quickly and usually think less of the long term of your business. It’s important to keep a realistic view. Consider the potential of the market, and recognize that if you have the customers and the products, you are bettering your positioning for investors.

6. Understand The Dynamic Between Startup and Investor

It’s important to keep in mind that there are more investors than there are quality startups. The power has shifted, so you have a better proposition for investors than vice versa. Put yourself in a position where investors need to convince you that they’re the best candidate for you to partner up with.

7. Do You Really Need Money? If So, What Will You Do With It?

Before seeking investments for your startup, consider if you really need the money or if you’re just creating unnecessary growth. Think about the why, the how, and the what. The ‘why’ is the long-term goals and growth potential. The ‘how’ is the means of earning. And the ‘what’ is what you’d be using your investments for. It’s important to know the reason why you are looking for investments. Remember that the price of money is huge. To justify the partnership with investors, make sure the pie gets bigger. When you have investors you lose a slice of the pie, but if the pie gets larger then it’s worth it.

Securing investment for your startup is a pivotal milestone on the path to success. By following the steps outlined in this blog by Nira, you can better understand your startup’s needs and appeal to potential investors if you see fit. By fostering relationships within startup ecosystems and seeking guidance from experienced mentors or advisors, you will position your startup for better and smarter investment opportunities.